Bogus Check Division

Tulsa County merchants lose millions of dollars because of bad checks. Consumers share in these losses through higher prices. The District Attorney's Office has a Bogus Check Restitution Program to track down bad check writers, return the money to the victims, deter future offenses and provide offenders an opportunity to avoid prosecution and criminal records in exchange for paying full restitution to victims.

In addition, this program alleviates case loads that burden the entire criminal justice system, in order to devote resources to more serious crimes.

How Does It Work?

If you receive a bogus check, the Tulsa County District Attorney’s Office is available to assist you in collecting the face value of the check plus a $25 Merchant Return Fee. This is done at no cost to the merchant. There also is no cost to the taxpayer to administer the program. The cost is covered by the check writer, who pays a fee to the District Attorney’s Office for each check returned.

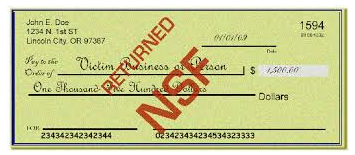

What is a Bogus Check?

A bogus check is one that is returned for insufficient funds, account closed or no account found.

How Do Merchants Use the Program?

Don’t let hot checks cool off in your files; the sooner we receive them, the more effective we can be in collecting them. Our merchant packets contain documents to send with bogus checks so that we may attempt to collect money owed you. Complete as much information on the affidavit as possible to help us be successful in collecting on your behalf. If we cannot collect voluntary restitution, the affidavit allows us to file criminal charges on the check writer, providing us another opportunity to collect the amount due.

How Do I Get My Money?

The check writer may be permitted to set up a payment plan through the District Attorney’s Office. When we collect on a check for you, we send a voucher directly to you until the original amount of the check is paid in full plus the $25.00 Merchant Return Fee.

How Do I Learn More?

Phone 918-596-4990, Monday-Friday 8:00 a.m. – 5:00 p.m.

Guidelines for the Program

There is NO CHARGE to you or any citizen who receives a bogus check. There IS a charge to the check writer.

How To Use The Program

1. A merchant may use this program immediately upon dishonor of a check.

2. When a check writer does not pay, bring a copy of the bank rejected check to the District Attorney's Supervision office on the 1st Floor of the Tulsa County Courthouse as soon as possible.

3. Don't allow the check writer to break promise after promise in order to gain extensions. This only allows the bad check writer to change residences and makes collection procedures more difficult.

Where Does the Check Writer Pay for Checks?

Once the bogus check is in the possession of the District Attorney, ALL PAYMENTS MUST BE MADE THROUGH THE DISTRICT ATTORNEY'S OFFICE. If you should encounter the bogus the check writer, direct him or her to contact the District Attorney's Supervision office on the 1st Floor of the Tulsa County Courthouse.

Restitution Agreement

When located, if the check writer is unable to make full payment at that time, the District Attorney may allow the check writer to enter into a Restitution Agreement payable over time. Please understand that when this happens the merchant will receive what is due them first, then any state fees or court costs will be paid last. Under this plan, the District Attorney may prosecute a check writer who fails to comply with his or her restitution agreement.

Helpful Suggestions

1. ASK FOR IDENTIFICATION.

A Driver's License is a good form of identification. Make sure the name on the Driver's License is the same as the name on the check. Look at the picture. Is it the same person?

You must be able to identify the check writer in case of prosecution.

2. INITIAL THE CHECK.

We must know which employee took the check.

3. LIST THE FOLLOWING INFO ON THE CHECK:

Driver's License Number and State of Issuance

Date of Birth

Physical Description (height, weight, hair and eye color)

Place of employment (or phone number)

These procedures take a little extra time, but will make a big difference in our ability to serve you. Businesses that do not ask for proper identification are likely to find themselves to be a favorite target of bogus check writers. Previously, checks with numbers below 300 were the majority of bad checks. However, a person can start their check numbers anywhere they want now. With this in mind some banks will print on the check the month and year that the account was opened. Be wary of new accounts.